Hybrid Line of Credit: Flexible Financing Options from Your Wyoming Credit Union

Hybrid Line of Credit: Flexible Financing Options from Your Wyoming Credit Union

Blog Article

Elevate Your Banking Experience With Cooperative Credit Union

Credit rating unions, with their focus on member-centric services and area participation, offer a compelling choice to standard banking. By prioritizing specific requirements and fostering a feeling of belonging within their membership base, debt unions have carved out a particular niche that reverberates with those looking for an extra individualized technique to managing their funds.

Advantages of Lending Institution

Another advantage of cooperative credit union is their democratic structure, where each member has an equal enact electing the board of supervisors. This makes certain that choices are made with the most effective passions of the participants in mind, as opposed to concentrating solely on making best use of profits. Additionally, cooperative credit union frequently provide economic education and learning and counseling to aid participants boost their monetary proficiency and make notified decisions concerning their cash. Overall, the member-focused technique of credit history unions sets them apart as institutions that focus on the well-being of their area.

Membership Requirements

Some debt unions may offer people that work or live in a specific geographical area, while others might be connected with details companies, unions, or associations. Additionally, household members of current debt union members are often qualified to join as well.

To come to be a participant of a lending institution, individuals are normally needed to open an account and keep a minimum deposit as defined by the organization. In many cases, there might be single membership charges or recurring membership dues. When the subscription requirements are met, people can delight in the advantages of belonging to a cooperative credit union, including access to personalized monetary services, competitive rate of interest, and a focus on member fulfillment.

Personalized Financial Providers

Individualized monetary solutions tailored to specific demands and preferences are a hallmark of lending institution' dedication to member fulfillment. Unlike conventional banks that commonly supply one-size-fits-all options, debt unions take a more customized method to managing their participants' financial resources. By comprehending the one-of-a-kind goals and scenarios of each participant, lending institution can provide customized suggestions on savings, investments, finances, and various other economic products.

Moreover, debt unions typically provide lower fees and affordable passion prices on cost savings and loans accounts, better enhancing the personalized financial services they supply. By concentrating on specific needs and providing tailored remedies, cooperative credit union establish themselves apart as trusted monetary companions dedicated to aiding members flourish financially.

Area Involvement and Assistance

Neighborhood involvement is a cornerstone of lending institution' objective, showing their commitment to supporting regional campaigns and fostering significant links. Cooperative credit union actively join area events, sponsor regional charities, and arrange economic proficiency programs to enlighten non-members and participants alike. By purchasing the areas they offer, lending institution not just reinforce their connections however likewise contribute to the overall well-being of society.

Sustaining small companies is one more means cooperative credit union show their commitment to neighborhood areas. site here Through using bank loan and financial suggestions, credit rating unions help entrepreneurs grow and boost financial development in the area. This support surpasses simply financial help; cooperative credit union typically provide mentorship and networking opportunities to aid local business are successful.

Furthermore, lending institution frequently engage in visit this site volunteer work, encouraging their participants and staff members to return through various community service activities - Credit Unions in Wyoming. Whether it's joining local clean-up occasions or arranging food drives, cooperative credit union play an energetic duty in enhancing the lifestyle for those in demand. By prioritizing neighborhood participation and support, cooperative credit union absolutely personify the spirit of teamwork and common help

Online Financial and Mobile Apps

In today's digital age, contemporary banking eases have actually been revolutionized by the prevalent adoption of mobile applications and online platforms. Credit unions are at the leading edge of this digital change, offering participants convenient and safe means to manage their funds anytime, anywhere. On-line banking solutions offered by cooperative credit union make it possible for members to i was reading this examine account equilibriums, transfer funds, pay bills, and view purchase history with simply a couple of clicks. These systems are designed with straightforward interfaces, making it simple for participants to browse and gain access to crucial financial functions.

Mobile applications provided by lending institution better enhance the banking experience by giving extra adaptability and availability. Members can execute different financial tasks on the go, such as transferring checks by taking a picture, getting account notices, and also speaking to client support directly with the application. The protection of these mobile apps is a leading priority, with features like biometric verification and file encryption methods to protect sensitive information. Generally, lending institution' on the internet financial and mobile apps equip participants to manage their funds effectively and safely in today's fast-paced digital globe.

Conclusion

In final thought, lending institution offer a distinct financial experience that prioritizes community participation, customized solution, and participant complete satisfaction. With lower charges, competitive rate of interest prices, and customized financial services, cooperative credit union accommodate specific demands and promote economic wellness. Their autonomous framework values member input and sustains local communities through numerous initiatives. By joining a cooperative credit union, individuals can boost their banking experience and build strong partnerships while delighting in the benefits of a not-for-profit banks.

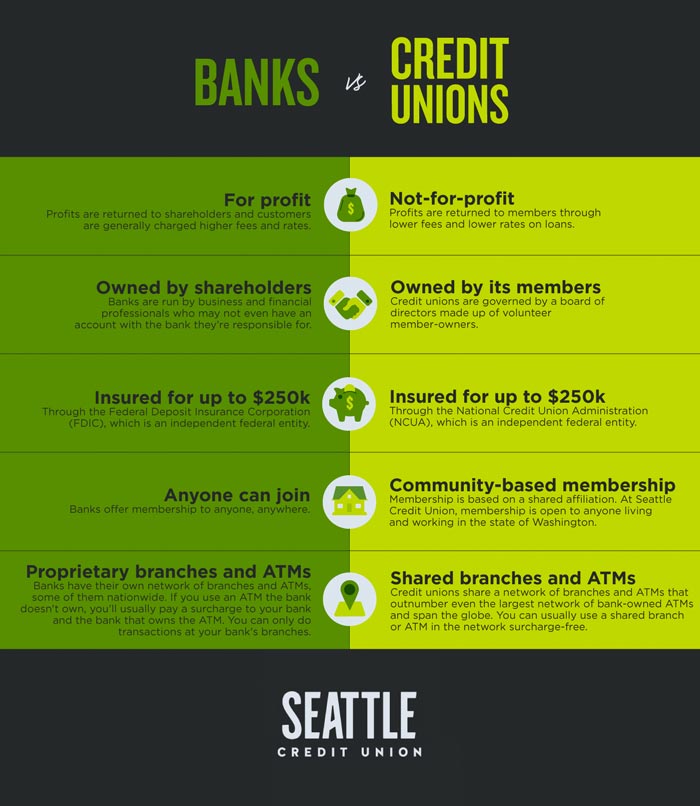

Unlike financial institutions, credit scores unions are not-for-profit organizations possessed by their participants, which commonly leads to decrease costs and better rate of interest prices on savings accounts, lendings, and credit rating cards. Furthermore, debt unions are understood for their individualized customer solution, with staff members taking the time to understand the one-of-a-kind financial objectives and obstacles of each participant.

Credit report unions often provide economic education and learning and therapy to aid participants enhance their financial proficiency and make informed decisions concerning their cash. Some credit rating unions may offer people that work or live in a certain geographical area, while others may be connected with particular business, unions, or associations. Additionally, family members of present debt union members are frequently eligible to sign up with as well.

Report this page